CASE STUDY

Cox Automotive Stays Ahead in a Shifting Auto Market With Morning Consult

The Customer

Cox Automotive is one of the most influential players in the global auto industry, operating brands like Manheim, Autotrader, and Kelley Blue Book. With its scale and reach, the company doesn’t just participate in the market — it helps shape it through industry benchmarks, forecasts, and data trusted by manufacturers, dealers, lenders, and policymakers.

The Challenge

Cox relies on early, accurate reads of consumer behavior. When policies shift, interest rates fluctuate, or EV tax credits change, auto market forecasts can become outdated overnight. Understanding how consumers will react to these shifts isn’t just valuable, it’s essential to leading the industry.

The Result

With Morning Consult Intelligence—the always-on consumer signal platform—Cox Automotive strengthened its economic forecasts, sharpened its EV insights, and improved regional demand modeling, helping its team react faster to policy changes and deliver more trusted industry benchmarks.

Want to hear more? Watch our conversation with Cox Automotive’s Chief Economist on how they use Morning Consult to strengthen forecasts

“I think it’s pretty clear and has been for more than five years that I’m a Morning Consult client, because there’s not a presentation I do that doesn’t have at least one chart from Morning Consult in it.”

The Challenge: Outdated and Incomplete Data

Traditional economic indicators and government reports provide a foundation for understanding the auto market, but they lag weeks, sometimes months, behind reality. For Jonathan Smoke, Chief Economist at Cox Automotive, and Stephanie Valdez Streaty, Director of Industry Insights, this delay created a major challenge:

- Policy changes (tariffs, EV tax credits, lending regulations) moved faster than the official data could reflect.

- Consumer attitudes toward EVs varied dramatically by geography, politics, and demographics — insights that government releases couldn’t capture.

- Forecasting accuracy was at risk without timely, consumer-level signals to complement historical norms.

“The government data we all rely on certainly sets the framework… but it’s not timely, it’s subject to large revisions, and it’s very slow to evolve. The idea of turning on a dime just isn’t possible.”

The Solution

To keep pace with a rapidly evolving market, Cox Automotive turned to Morning Consult’s always-on Intelligence platform — giving their team daily, granular consumer insights unavailable anywhere else.

With the Morning Consult’s Intelligence platform, the Cox Automotive team can:

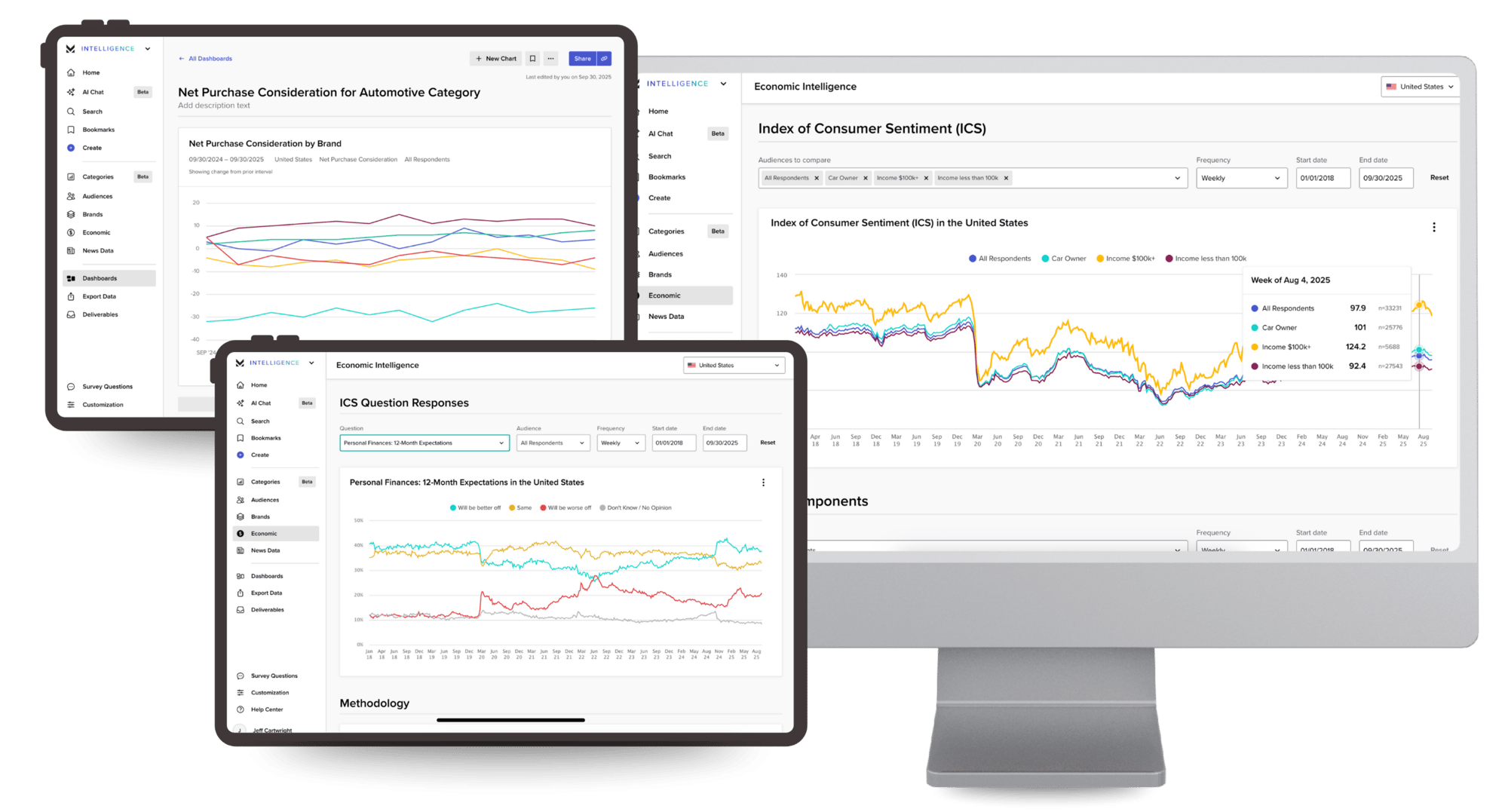

- Access a centralized, self-serve platform of consumer insights pulled from thousands of daily surveys, providing a reliable starting point for forecasts and presentations.

- Build custom dashboards and reports for key audiences and markets, enabling segmentation by demographics, geography, and political affiliation to inform strategy.

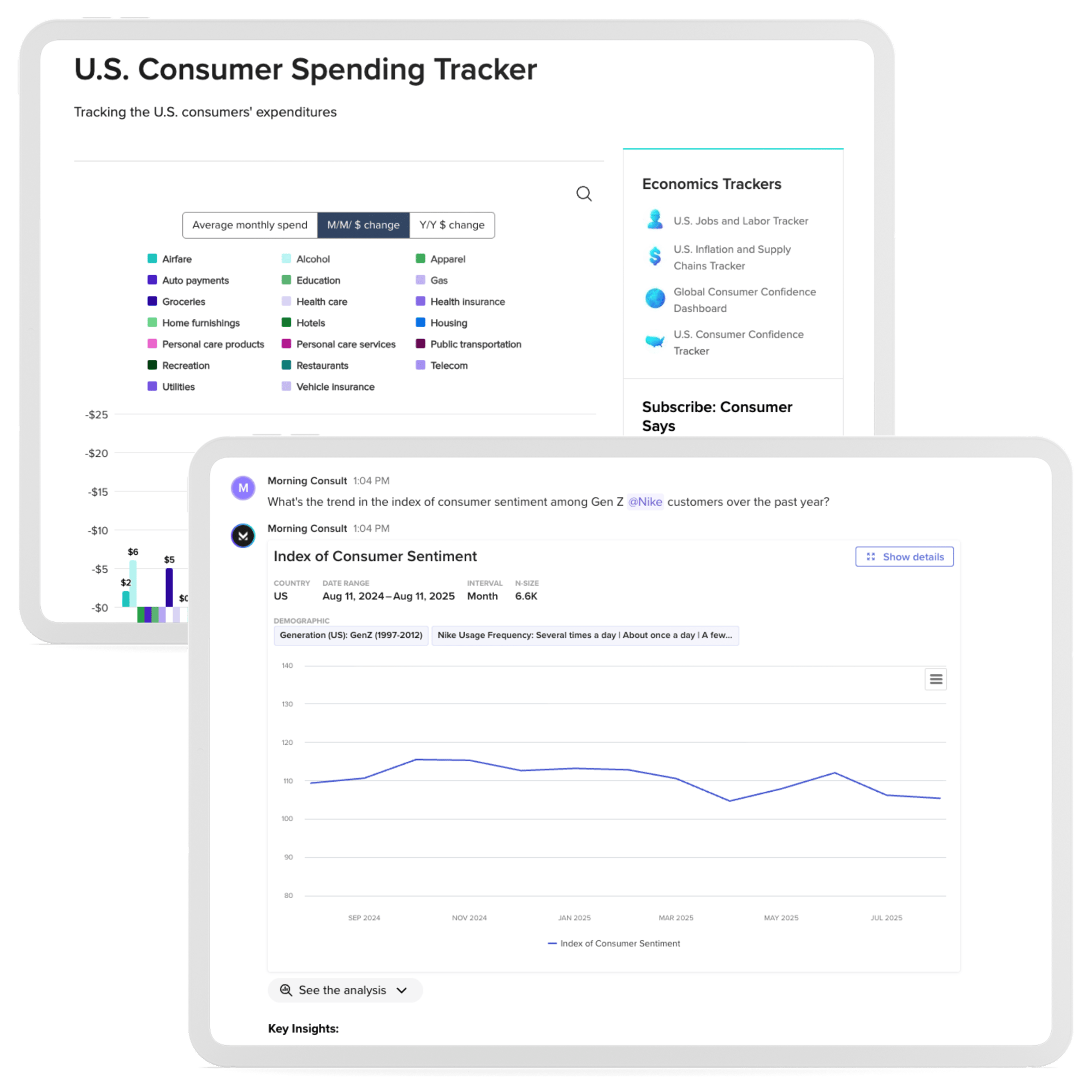

- Leverage proprietary indexes and dashboards on consumer, economic, and political trends, including the Consumer Health Index (CHI) and Index of Consumer Sentiment (ICS), to enrich presentations, keep stakeholders informed, and support data-driven decisions.

- Work directly with Morning Consult economists to put daily consumer signals in context, translating them into insights that strengthen forecasts and reinforce industry benchmarks like the Manheim Used Vehicle Value Index.

“It's the 'daily' part for me. I literally start every day wondering what the latest number represents because we live in a world that's still changing pretty substantially day in and day out, so I'm eager to see the data.”

The Impact:

Morning Consult’s data has become a critical input across Cox Automotive’s most influential outputs:

- Faster reactions to policy shifts: From tariffs to EV tax credit expirations, Cox can now spot demand surges or declines in real time and update forecasts accordingly.

- Sharper Automotive and EV insights: Daily tracking of consumer attitudes toward EVs (and toward automakers themselves) informs analyses used by manufacturers, dealers, and policymakers.

- More accurate regional forecasts: By layering consumer sentiment on top of government releases, Cox can pinpoint differences in demand across regions and income groups.

“The Morning Consult Intelligence platform is an incredible tool that significantly enhances my work. The team is amazing to work with – they are very responsive, possess expert knowledge, and always provide helpful ideas.”

The Bottom Line

Cox Automotive doesn’t just participate in the auto market — it helps define it. With Morning Consult’s always-on consumer intelligence, Cox’s economists and analysts can see around corners, respond to volatility, and deliver trusted forecasts that guide manufacturers, dealers, lenders, and policymakers across the industry.

Try MorningConsult.AI Today

Your first insights are just a question away.

Curious how daily consumer signals can sharpen your forecasts?

Explore the breadth of economic indicators available in the platform, or contact us to learn how Morning Consult can help your team stay ahead of market shifts.

Book A Demo

Interested in learning more about what our always-on consumer intelligence can do for your organization?