Real-time, high-frequency economic intelligence built for business decisions.

Morning Consult delivers the speed and scale traditional economic indicators can’t. We track consumer sentiment, spending, inflation and more in real time — giving leaders the early signals to act before the market moves.

Real-time, high-frequency economic intelligence built for business decisions.

Morning Consult delivers the speed and scale traditional economic indicators can’t. We track consumer sentiment, spending, inflation and more in real time — giving leaders the early signals to act before the market moves.

When the world moves, demand moves with it

Market Volatility

Interest rate swings, earnings shocks, and sell-offs ripple through consumer confidence and spending in hours, not weeks.

Geopolitical Turmoil

Conflicts, trade disputes, and energy shocks disrupt supply chains and reshape global demand overnight.

Social and Digital Upheaval

Viral moments and platform shifts can change buying behavior almost instantly.

Confident decisions start with timely economic insight, and high-stakes moments demand today’s data — not last month’s.

THE LATEST

Morning Consult's Jobs Data Shows a Weakening Labor Market

With government jobs data delayed due to the shutdown, watch Morning Consult Chief Economist John Leer join CNBC to discuss what our high-frequency data says about the state of the labor market.

Our Economic Intelligence in Action

Morning Consult’s always-on, high-frequency economic signals are one part of our comprehensive intelligence solutions — connecting macroeconomic shifts to consumer, brand, and market context so leaders can act with confidence.

How business leaders put our economic intelligence to work:

CFOs & Financial Teams

Monitor consumer and market shifts in real time to update forecasts, assess risk, and guide investment or resource allocation

Investor Relations

Contextualize performance for investors by tying company results to timely, trusted economic and consumer indicators

Corporate Insights

Track demand signals and sentiment shifts to uncover growth opportunities, refine targeting, and inform product or market strategies

Core economic indicators include:

FEATURED DATASET

Consumer Health Index: Monitor Real-Time Shifts in Demand

Our Consumer Health Index is a proprietary metric that estimates consumers' overall demand by combining a predictive measure of ability to afford purchases with a real-time indicator of willingness to spend.

The Consumer Health Index can be applied across all of Morning Consult’s full suite of detailed demographic groups, including custom audiences and brand-specific segments.

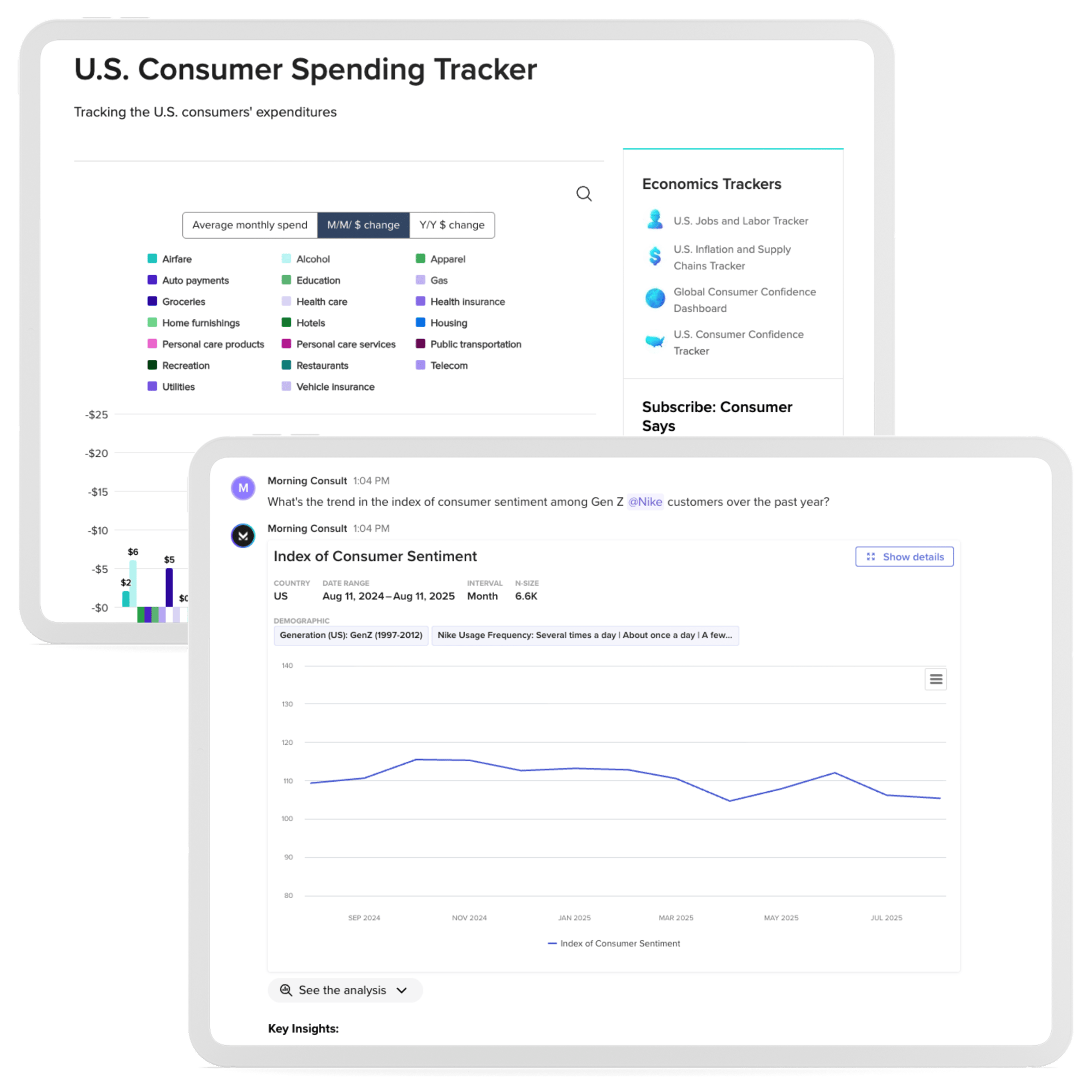

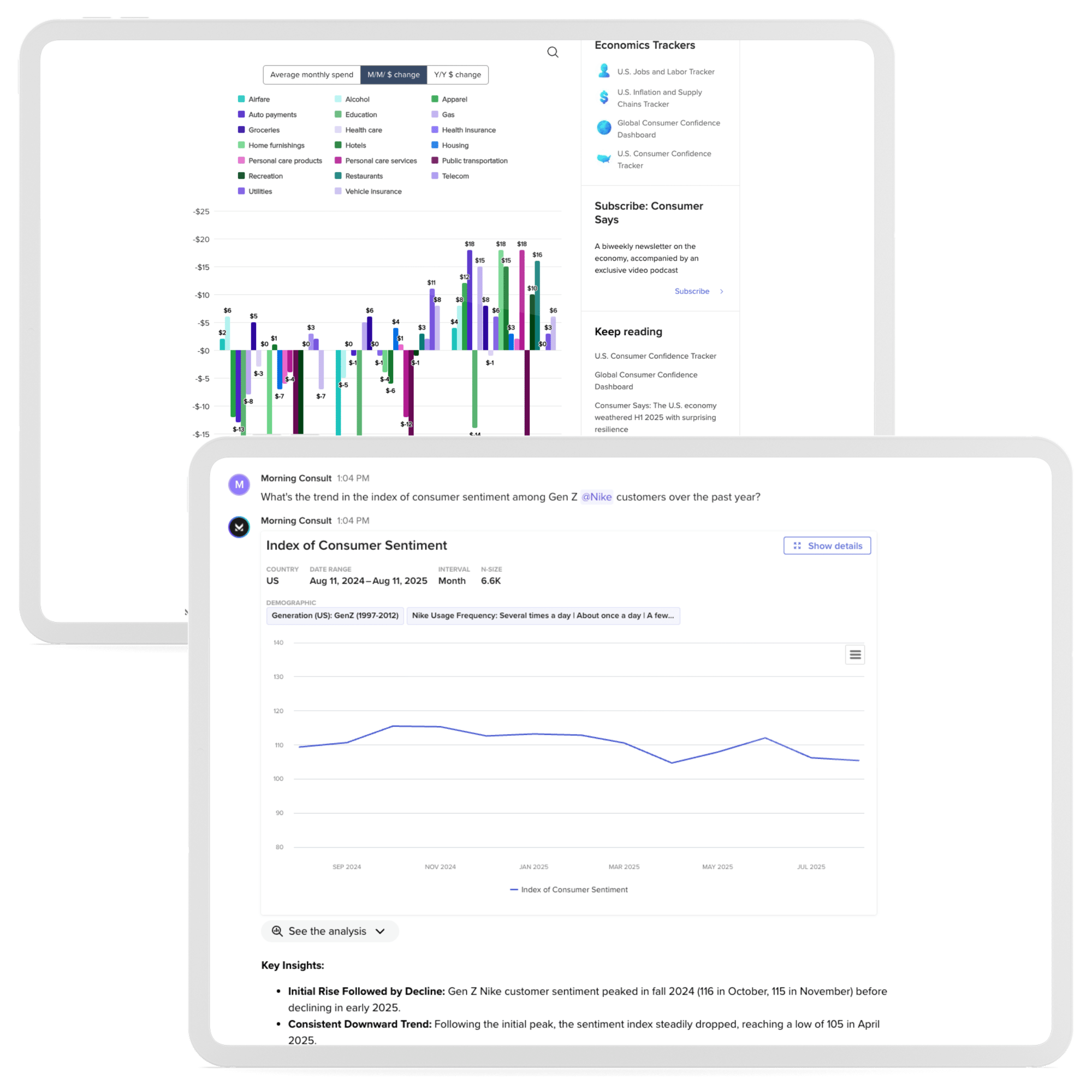

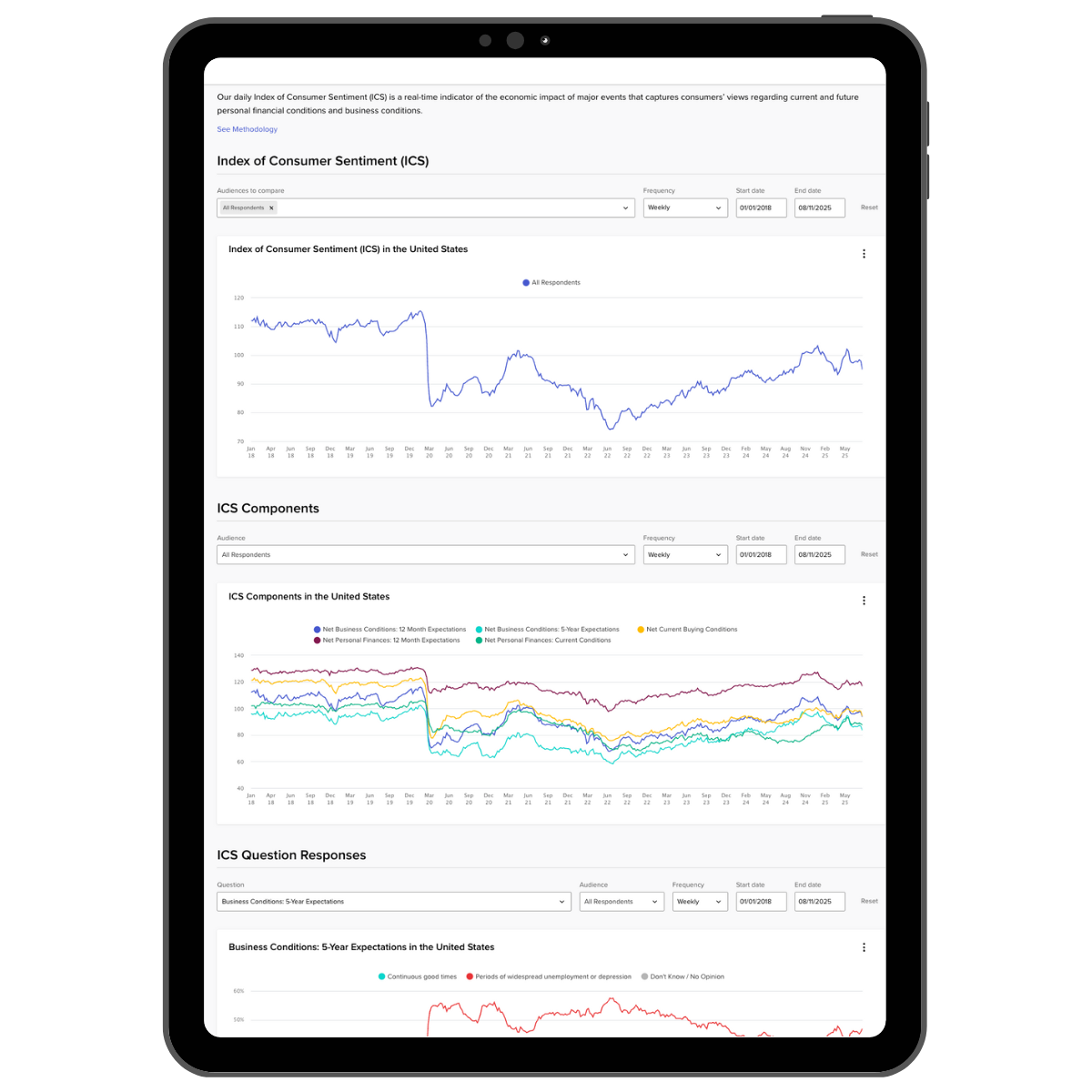

Index of Consumer Sentiment

Daily readings from 15,000+ global consumers using the same core questions as the University of Michigan Survey of Consumers—delivering sentiment insights with far greater frequency and detail.

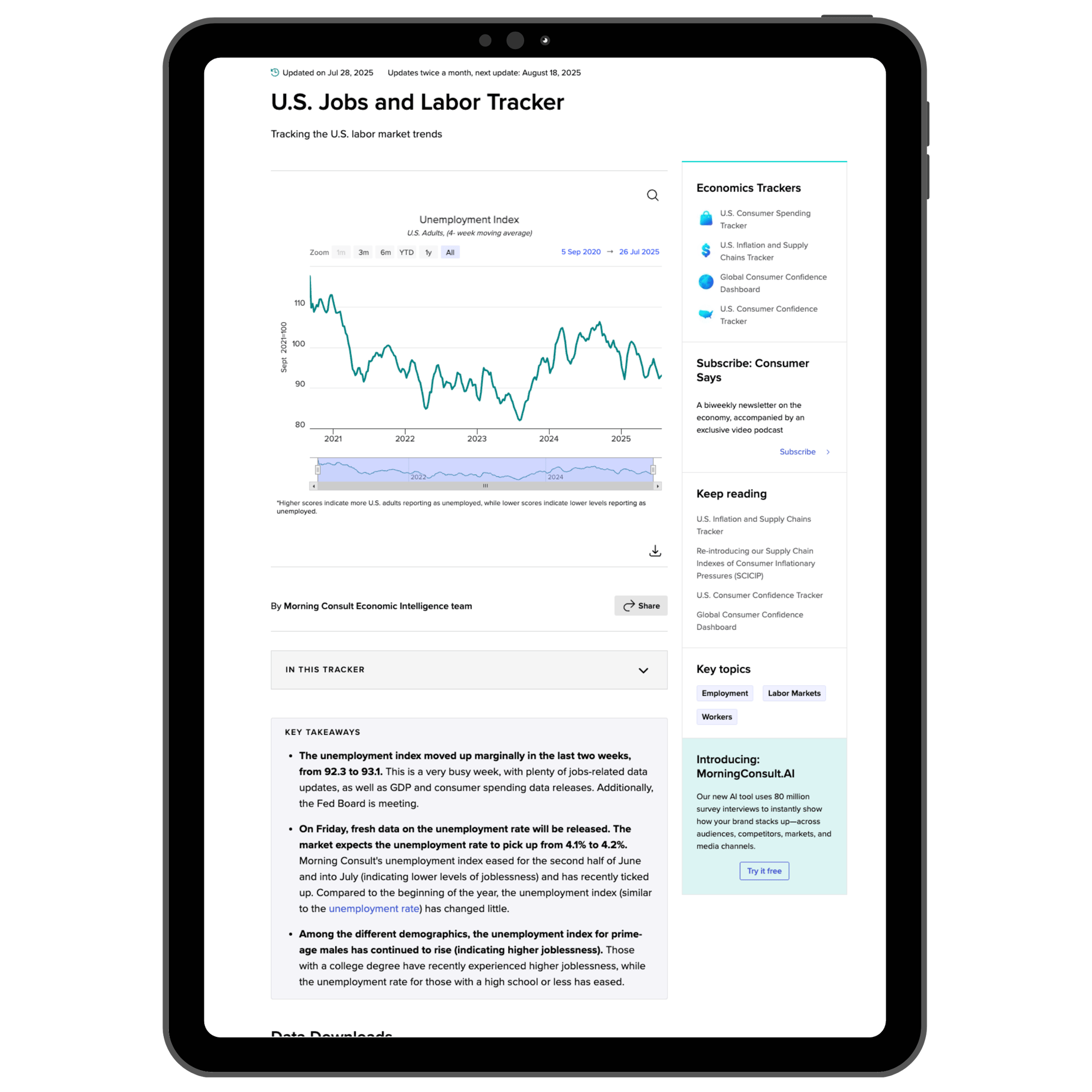

Jobs and Labor

High-frequency labor market data collected daily since 2020, tracking employment status and job search activity.

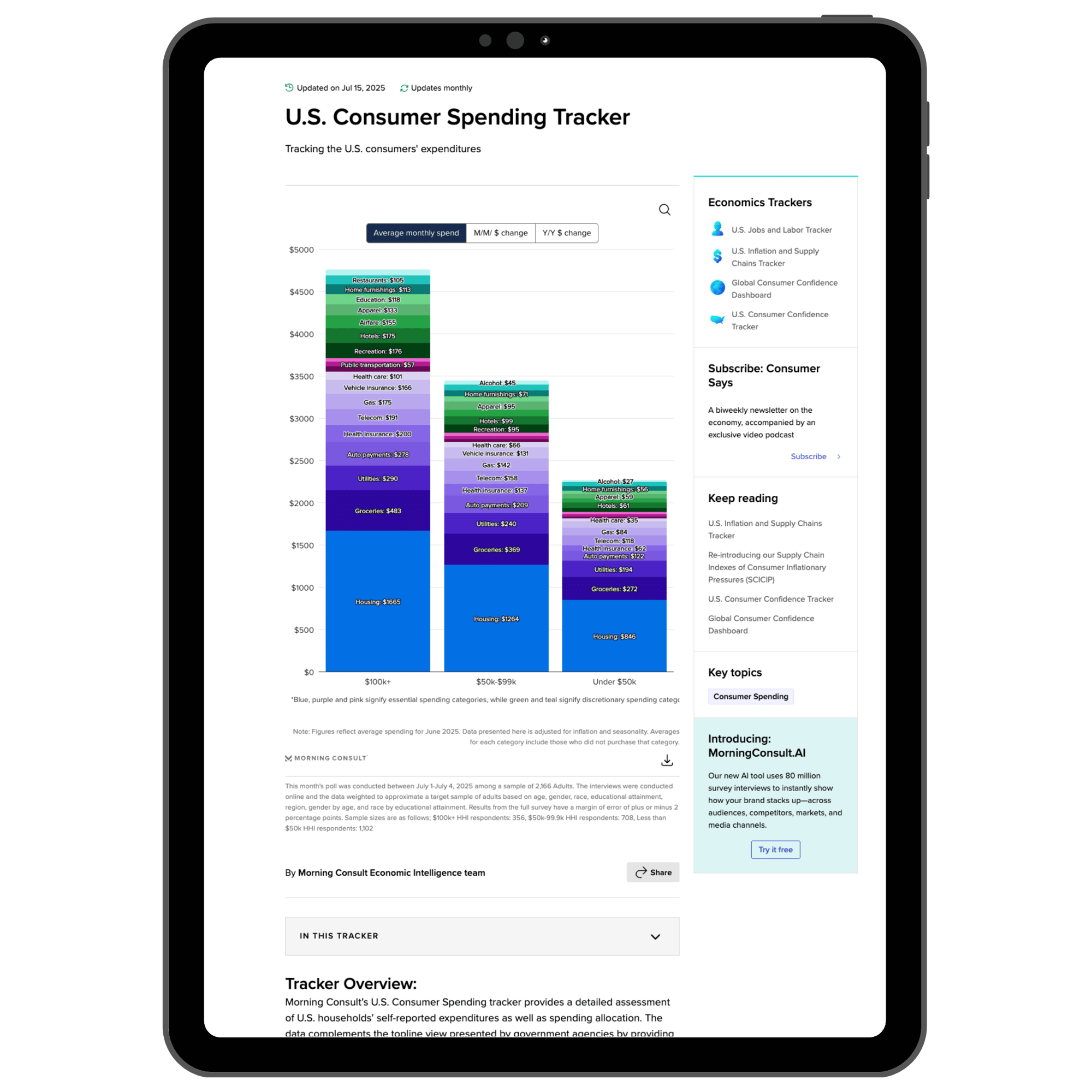

U.S. Consumer Spending

A monthly, inflation- and seasonally-adjusted view of household spending and allocation—capturing granular category, demographic, and income-level detail.

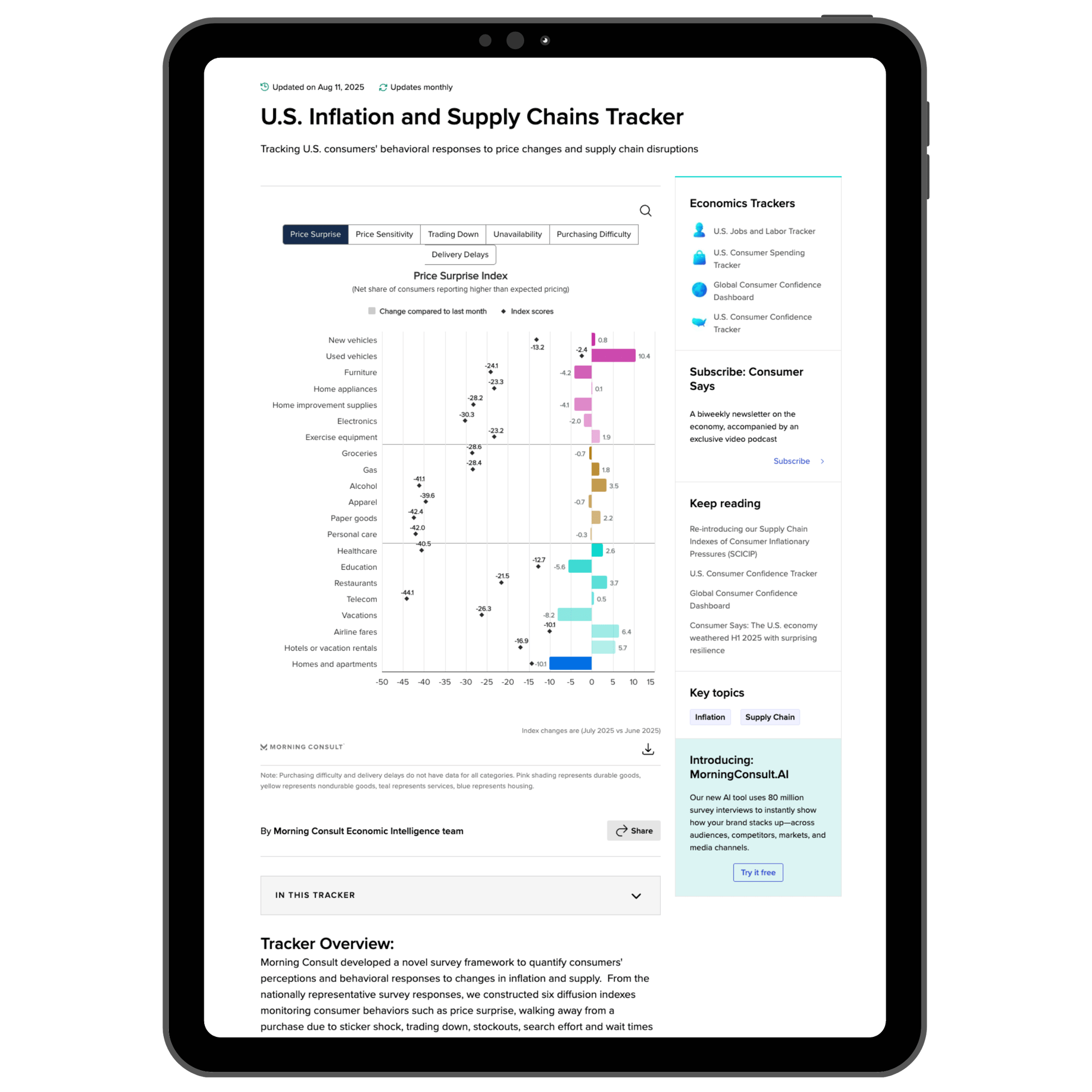

U.S. Inflation and Supply Chains

Six proprietary indexes tracking how U.S. consumers respond to price changes and supply disruptions—covering price surprise, sensitivity, trading down behavior, unavailability, purchasing difficulty, and delivery delays.

Trusted by the world's economic decision makers

Central banks, global policymakers, and corporate leaders rely on Morning Consult’s economic intelligence to guide strategy, allocate resources, and anticipate change.

-

Chicago Fed Advance Retail Trade Summary (CARTS)

-

An unconventional weekly

economic activity index for Germany -

Indirect consumer inflation expectations: Theory and evidence

-

Indirect Consumer Inflation Expectations

-

Blending Traditional and Alternative Labor Market Data with CHURN

-

Small and Medium-sized Businesses’ Expectations Concerning Tariffs, Costs, and Prices

-

Chicago Fed Advance Retail Trade Summary (CARTS)

-

An unconventional weekly

economic activity index for Germany -

Indirect consumer inflation expectations: Theory and evidence

-

Indirect Consumer Inflation Expectations

-

Blending Traditional and Alternative Labor Market Data with CHURN

-

Small and Medium-sized Businesses’ Expectations Concerning Tariffs, Costs, and Prices

Why Morning Consult

Official-grade insights. Real-time speed.

Traditional economic indicators set the benchmark—but their data lands weeks or months later. Our proprietary tech surveys 30,000 people daily in 40+ markets, delivering rigorous economic intelligence you can act on today.

Macro meets micro

We pair economic, political, and cultural context with brand and audience insight—turning siloed metrics into a complete view of your market.

Expert economists and white-glove service

You’re not just getting data—you’re getting our team. Expert briefings, bespoke analysis, and direct access to our economists ensure you’re never interpreting the numbers in a vacuum

Official-Grade Insights. Real-time speed.

Traditional economic indicators set the benchmark—but their data lands weeks or months later. Our proprietary tech surveys 30,000 people daily in 40+ markets, delivering rigorous economic intelligence you can act on today.

Macro Meets Micro

We pair economic, political, and cultural context with brand and audience insight—turning siloed metrics into a complete view of your market.

Expert Economists and White-Glove Service

You’re not just getting data—you’re getting our team. Expert briefings, bespoke analysis, and direct access to our economists ensure you’re never interpreting the numbers in a vacuum