CATEGORY ADVANTAGE

Go beyond traditional brand tracking with Category Advantage

A low-cost, AI-powered brand measurement solution that reveals the moments and needs driving consumers in your category — and how your brand can own more of them. Built on validated principles of brand-driven growth and powered by Morning Consult’s industry-leading sampling technology.

Results in 4-5 days.

Why Category Advantage

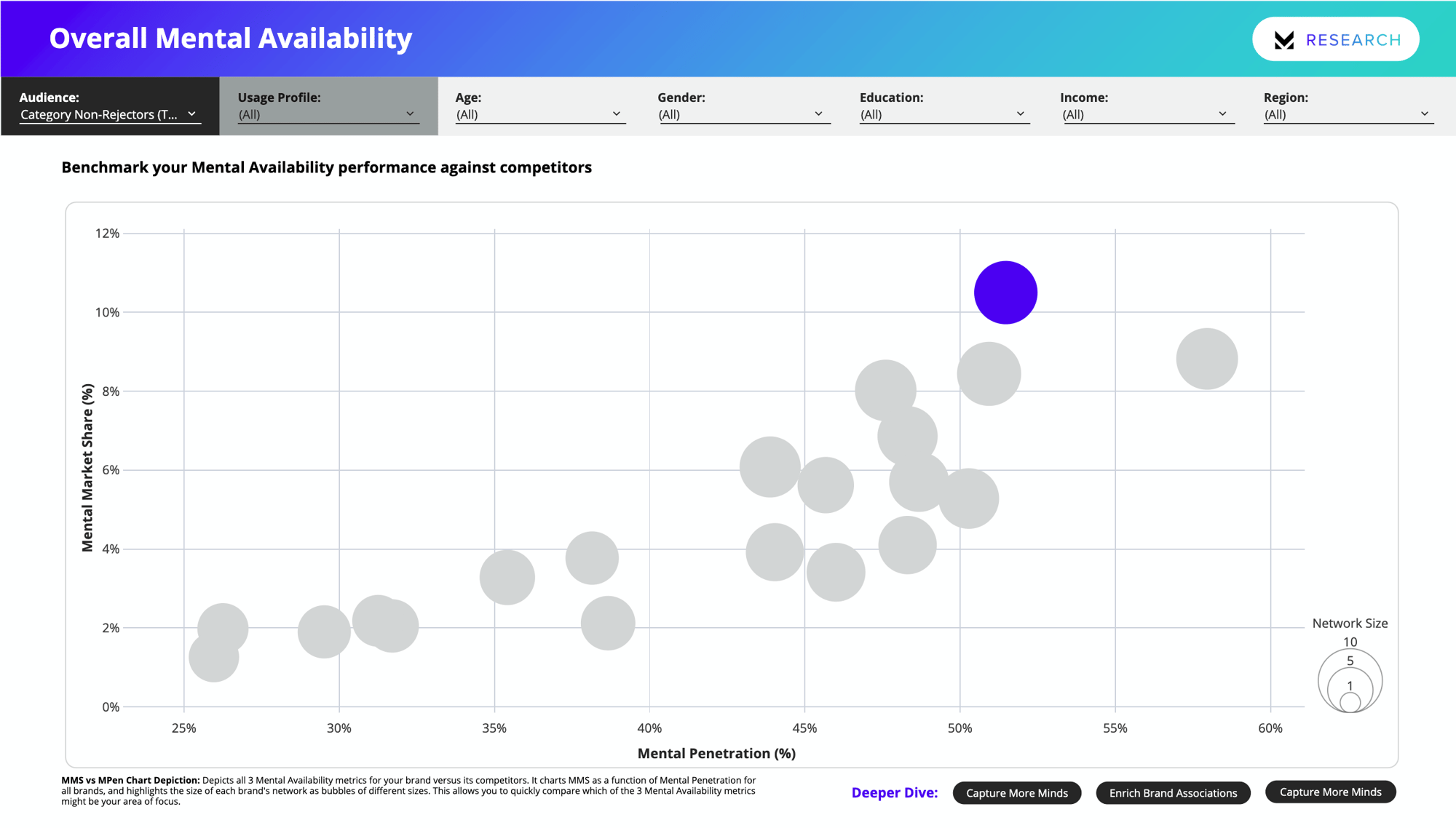

Measure the true drivers of brand strength

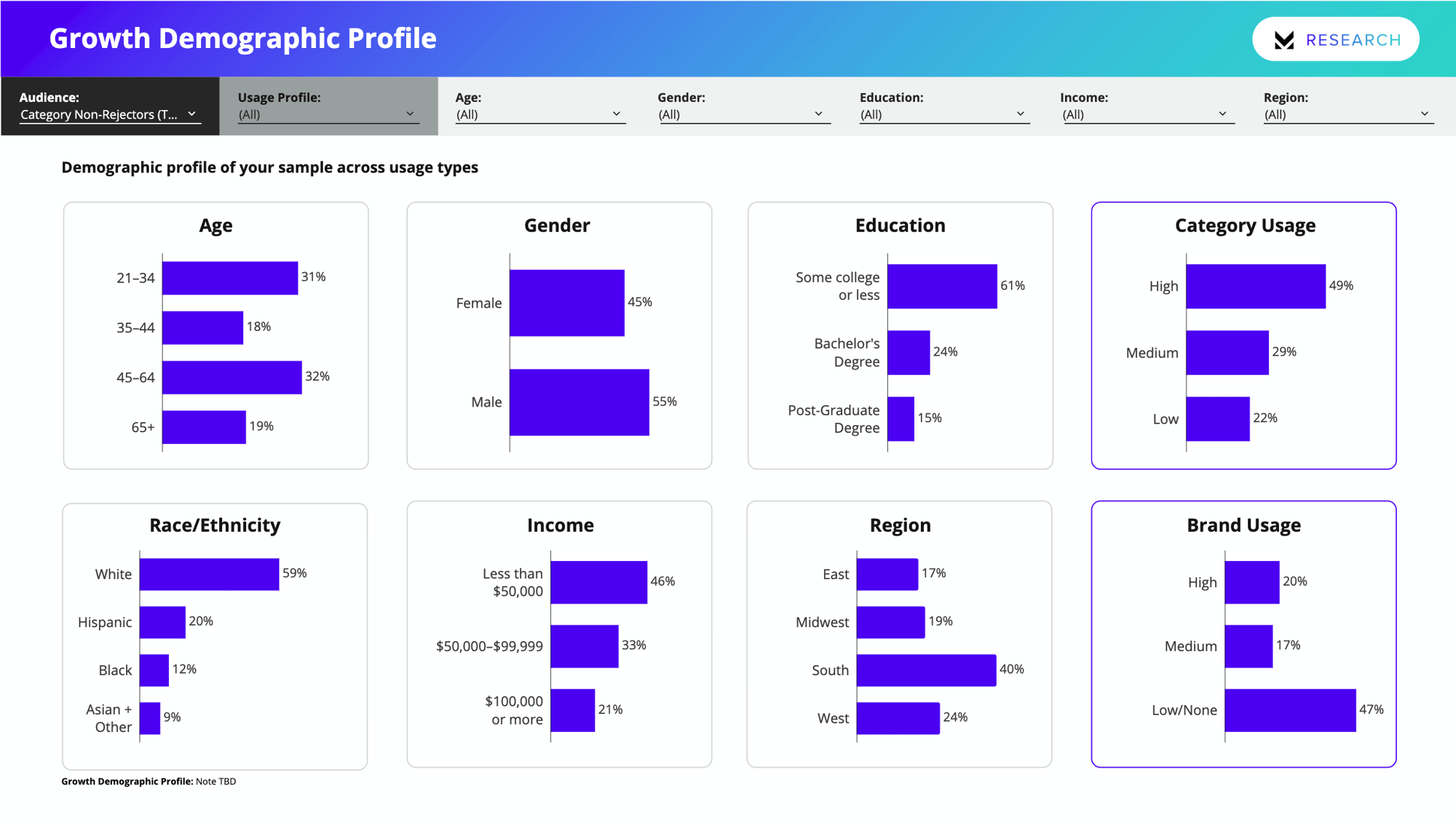

Capture both mental availability (the likelihood your brand comes to mind when consumers face a need or occasion) and emotional closeness (how strongly consumers connect with your brand), benchmarked against competitors.

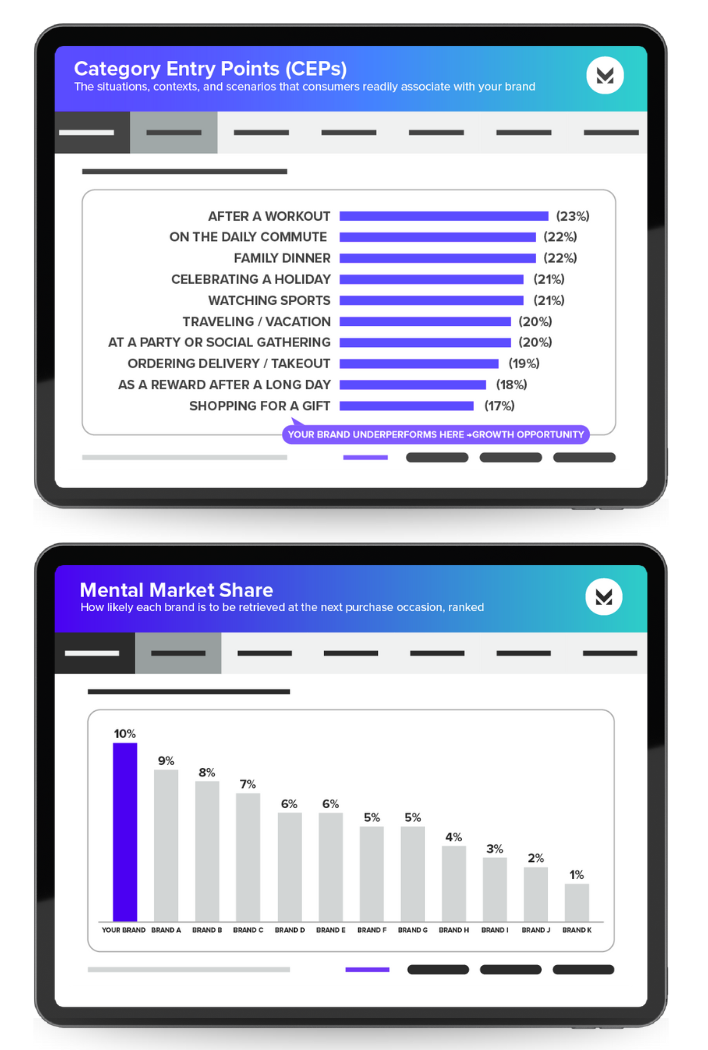

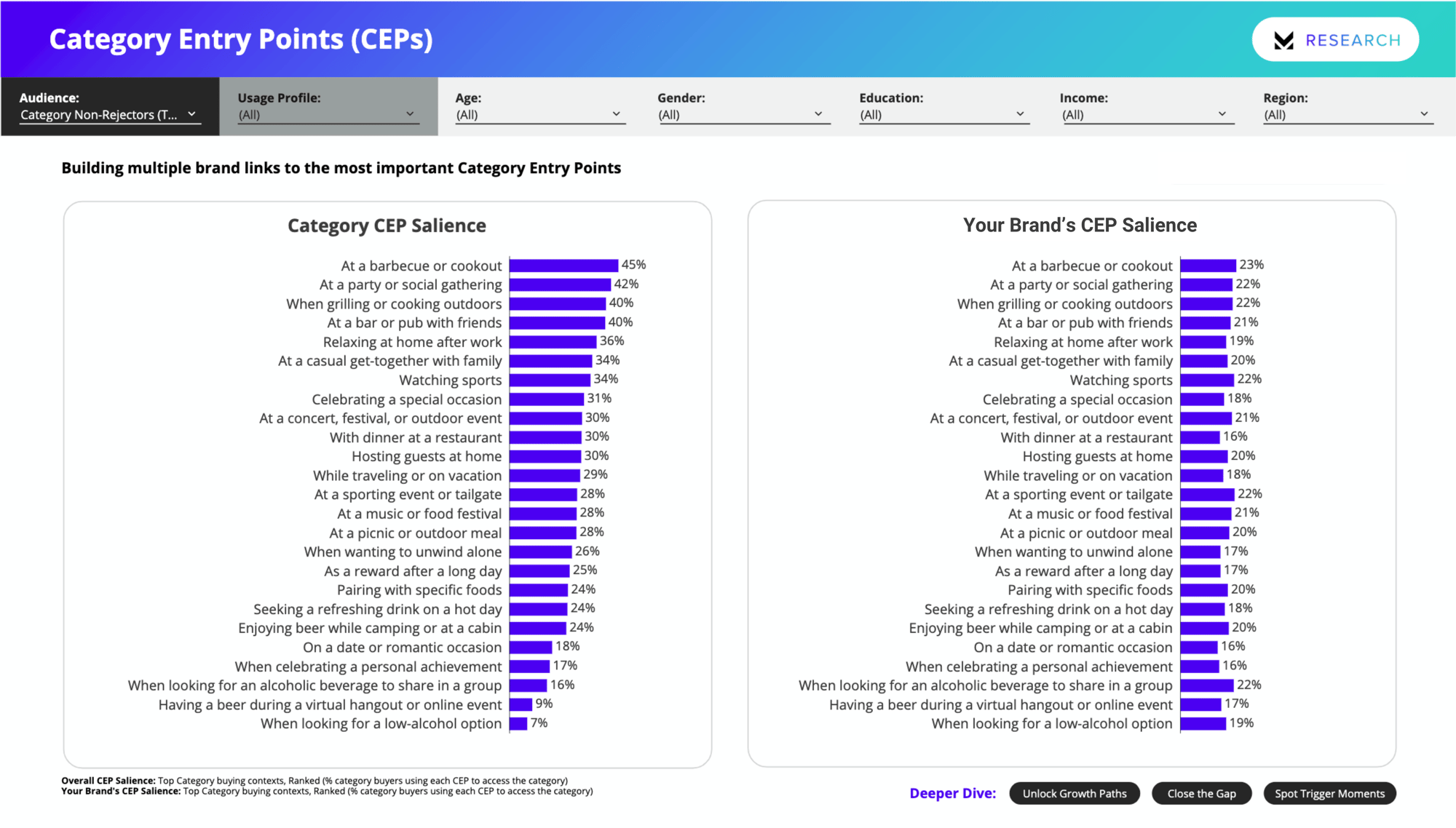

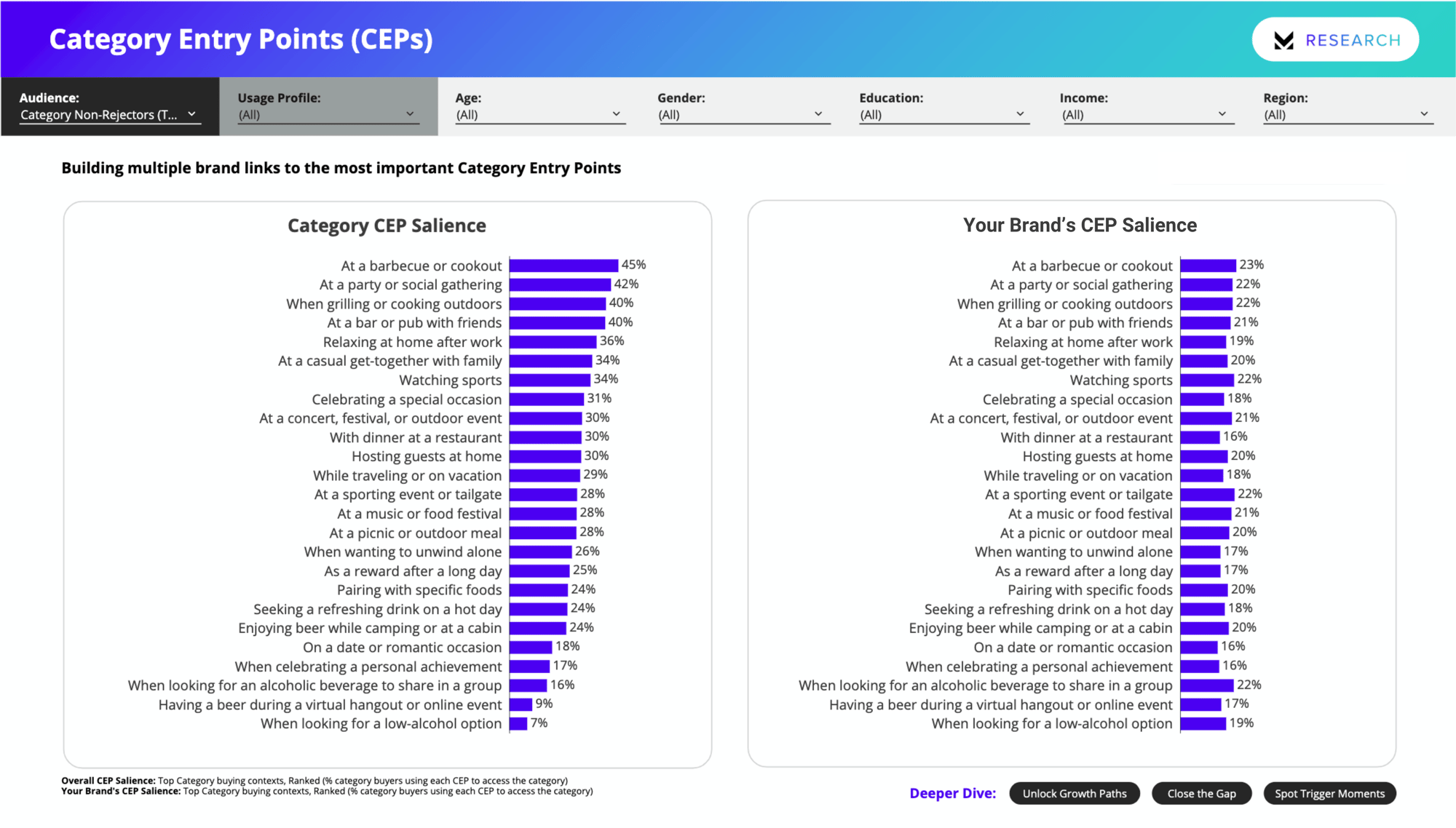

Uncover Category Entry Points (CEPs)

Directly tied to mental availability, see the specific needs, occasions, and triggers that drive purchase decisions in your category, and how strongly your brand is linked to them.

Uncover Category Entry Points (CEPs)

Directly tied to mental availability, see the specific needs, occasions, and triggers that drive purchase decisions in your category, and how strongly your brand is linked to them.

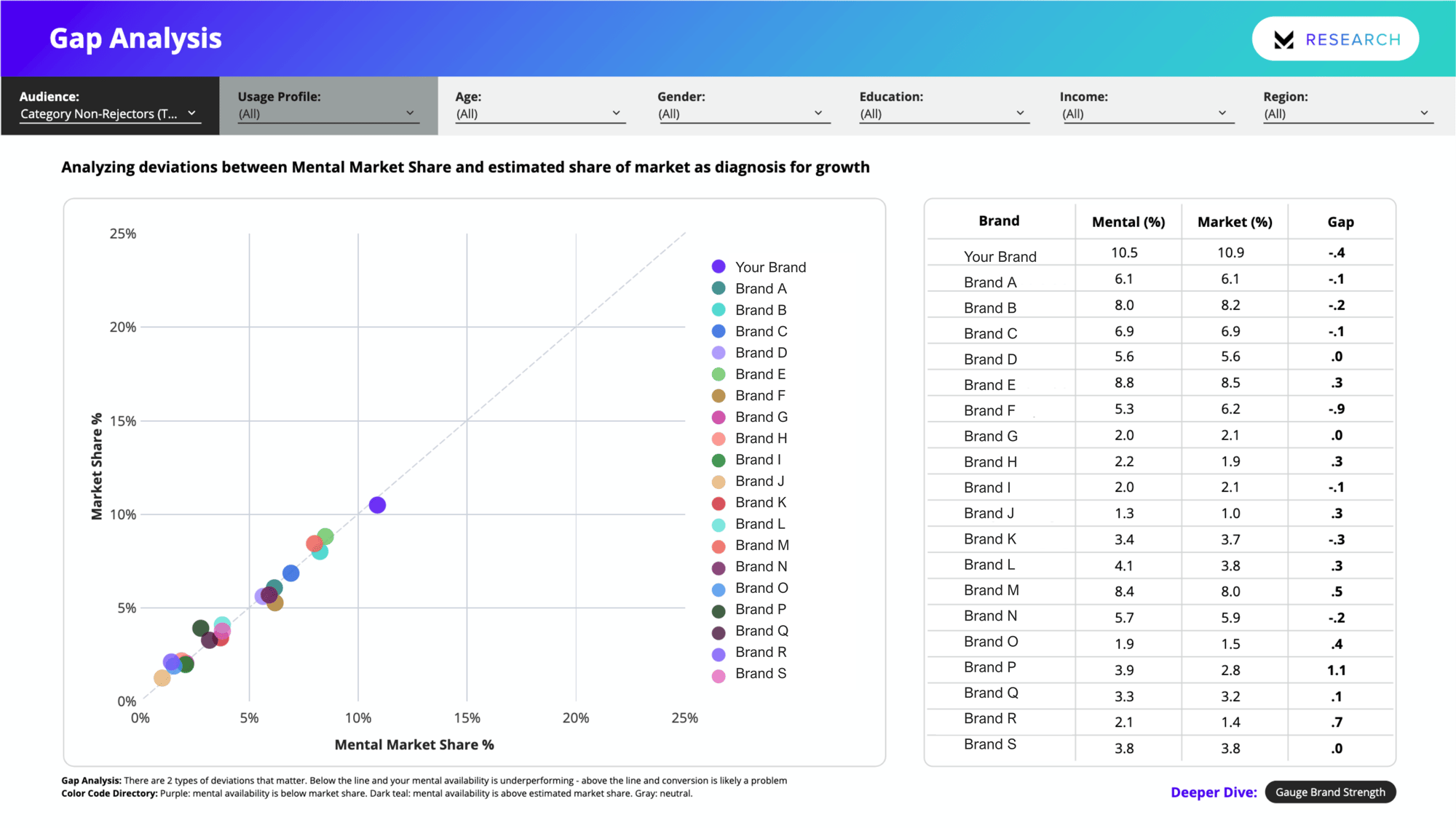

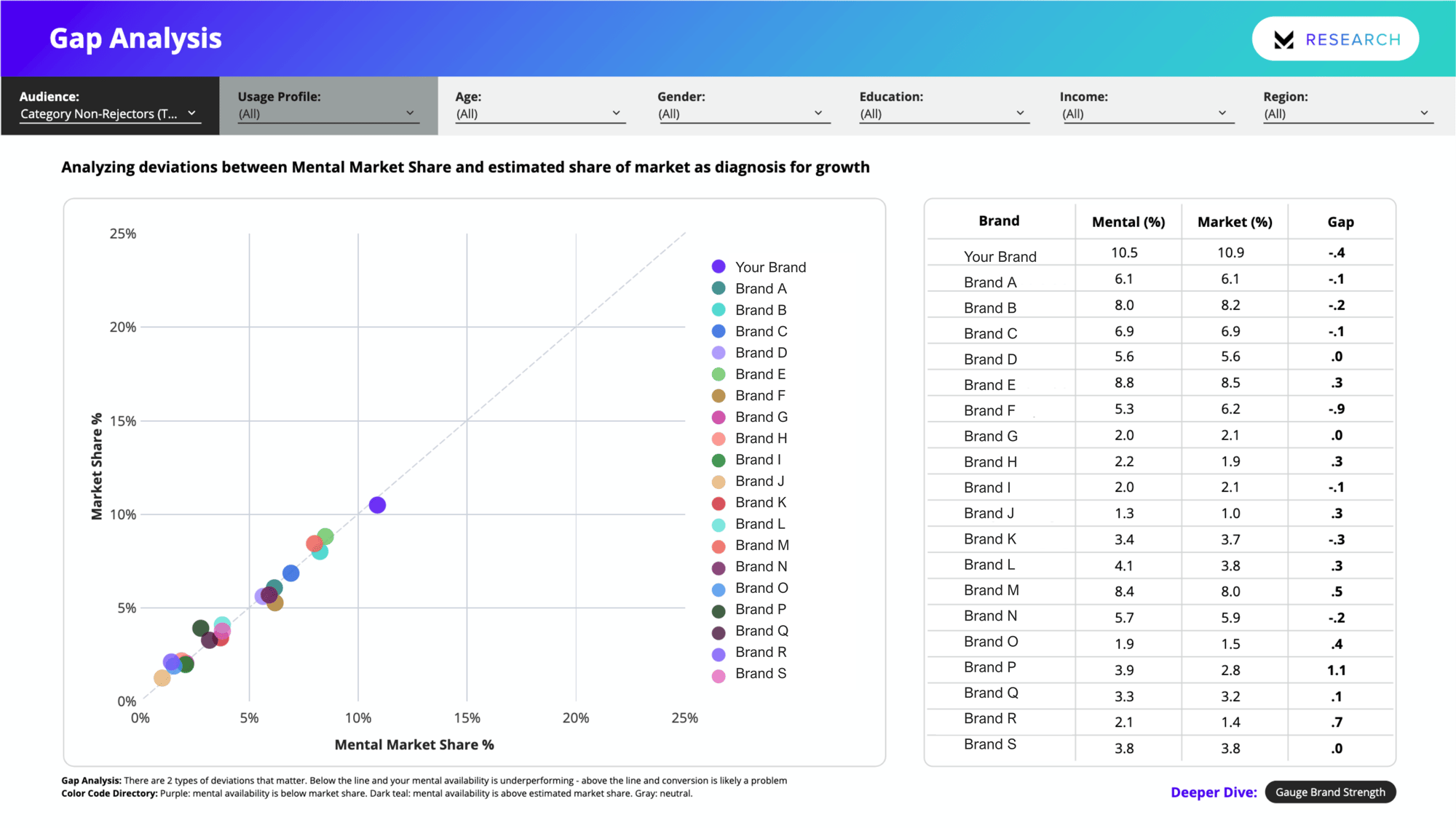

Pinpoint growth opportunities

Direct investment toward the moments and consumer segments with the greatest potential to grow your brand.

Turn insights into action fast

Get survey results in 4–5 days through a centralized dashboard and short-form memo that equips stakeholders with clear direction on where and how to win.

Turn insights into action fast

Get survey results in 4–5 days through a centralized dashboard and short-form memo that equips stakeholders with clear direction on where and how to win.

Hear from Our CEO

In his recent Morning Consult NEXT keynote, our CEO explains why traditional brand trackers are too slow, too static, and too expensive — and how Category Advantage changes the game.

How It Works

From kickoff to delivery, the entire process takes just 4-5 days.

Intake & Kickoff:

Fielding:

Delivery:

Backed By Evidence

Academic, industry, and Morning Consult research consistently show that mental availability and emotional closeness drive real-world business growth across categories and time frames.

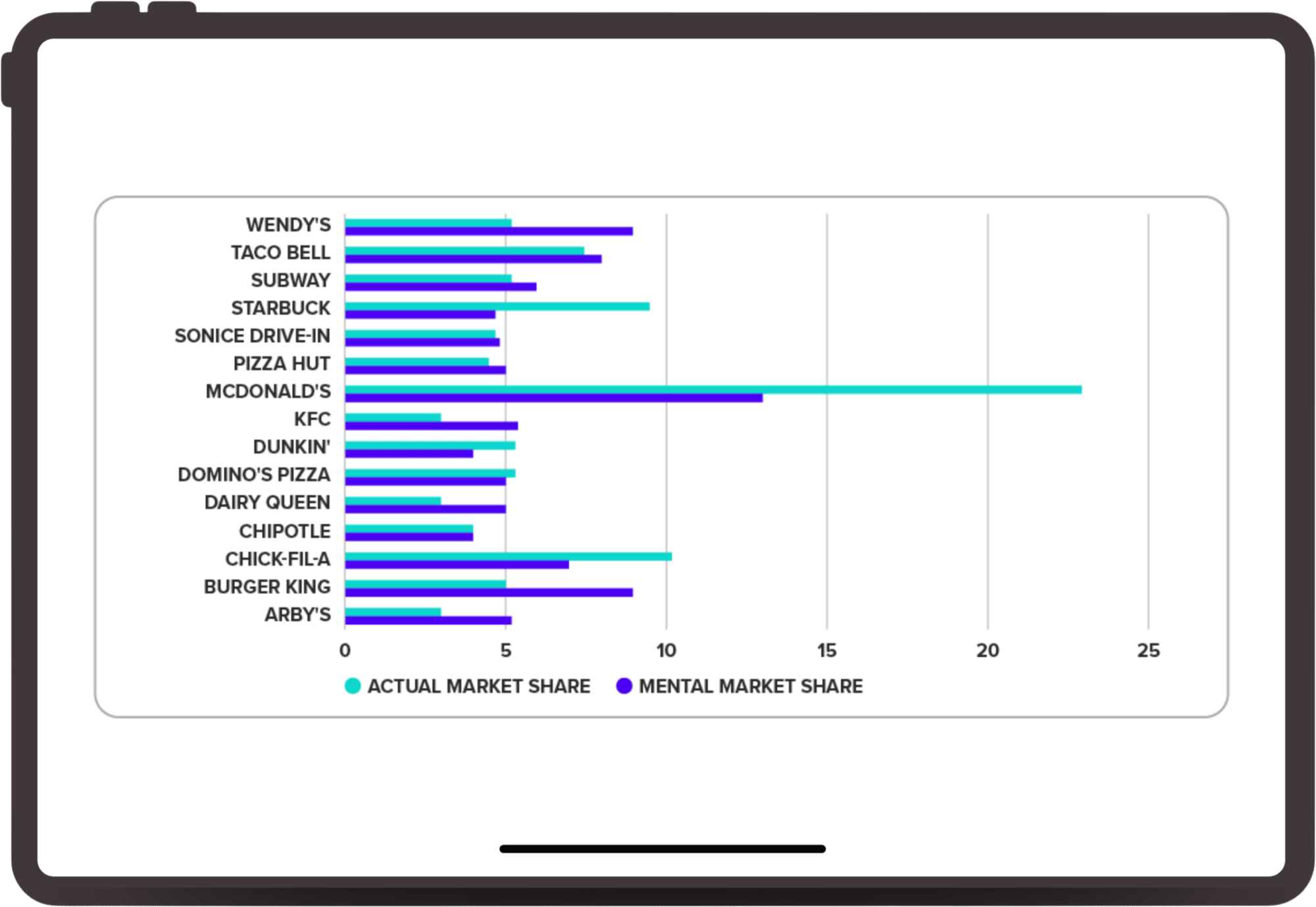

Mental vs. Actual Market Share of QSR Brands

Brands with stronger mental market share are more likely to convert salience into actual market share.

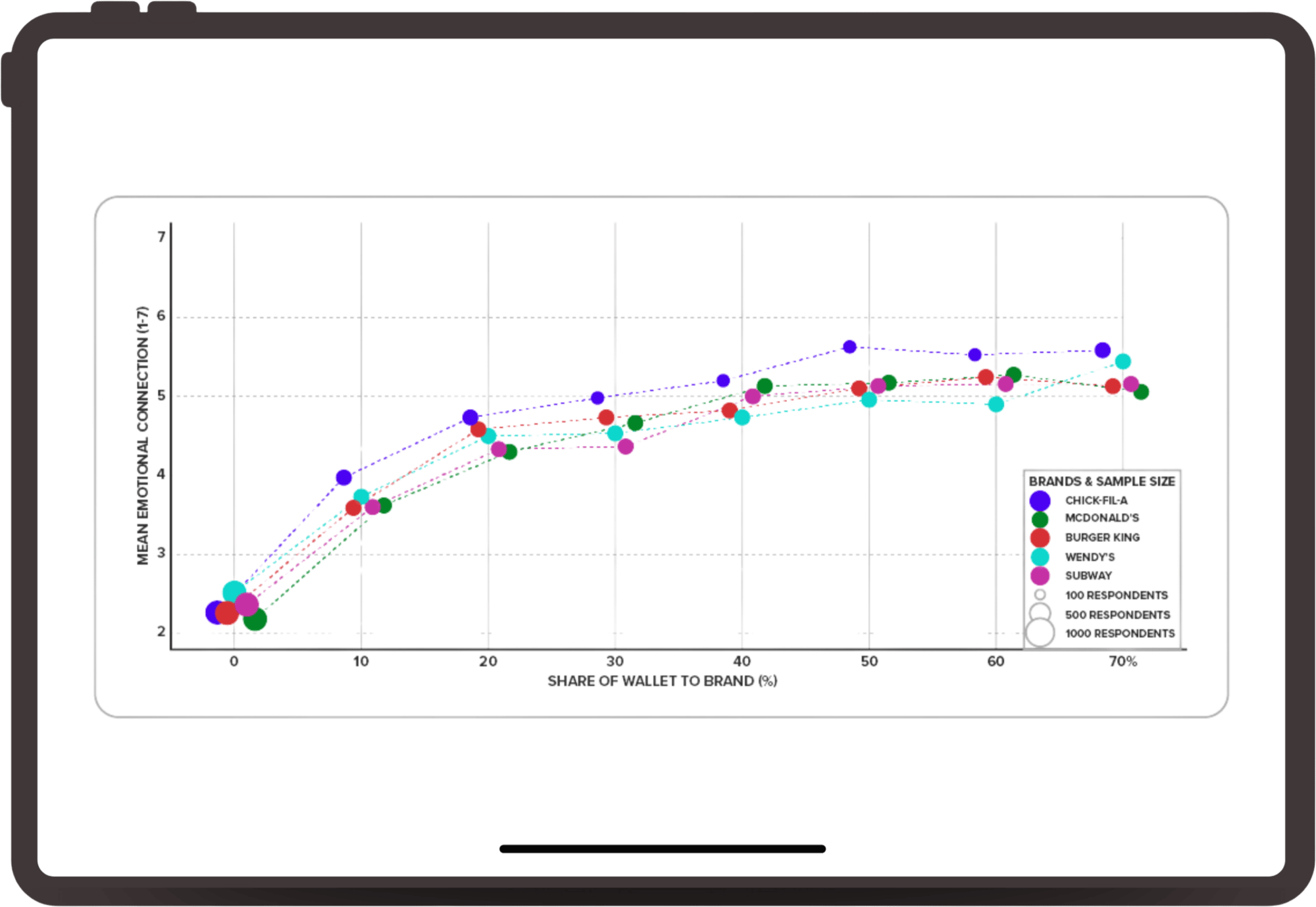

Emotional Connection vs. Stated Share of Wallet for Fast Food Brands

Higher emotional connection correlates with a greater stated share of wallet.